For Issuers

Issuing Your First Bond? Make It a Strategic Move.

Issuing a bond can feel like a bold step — especially for first-time issuers. Capital markets may seem complex, unfamiliar with high-stakes. But, with the right partner, that step becomes a strategic milestone.

CGIF: A Trusted Guarantee from a Trusted Institution

The Credit Guarantee and Investment Facility is a trust fund of the Asian Development Bank (CGIF) backed by the governments of ASEAN+3 countries.

Its mandate: to deepen and broaden local currency bond markets across the region.

CGIF partners with eligible companies — including many first-time issuers — to help secure long-term, stable funding for growth, capital restructuring, or risk management. We don’t just enable access to capital. We unlock market confidence.

What a CGIF Guarantee Brings to Your Bond

At the core of our support is an irrevocable, unconditional guarantee — covering up to 100% of your bond’s principal and interest payments.

This allows your bond to inherit CGIF’s AA global rating from S&P, which in turn helps you achieve: Tighter pricing

- Longer tenors (up to 10–15 years)

- Access to broader investor bases

- Cross-border issuance flexibility

- Fixed-rate structures with long-term stability

In short, a CGIF guarantee de-risks your transaction — so the market can focus on your opportunity, not your risk profile.

Find out how CGIF can support your bond journey.

CGIF’s bond guarantee operation is aimed at supporting ASEAN+3 companies access the region’s bond markets to achieve the following benefits:

- Expand and diversify their sources of debt capital

- Raise funds in matching currencies and tenors

- Transcend country sovereign ceilings for cross-border transactions

- Gain familiarity in new bond markets

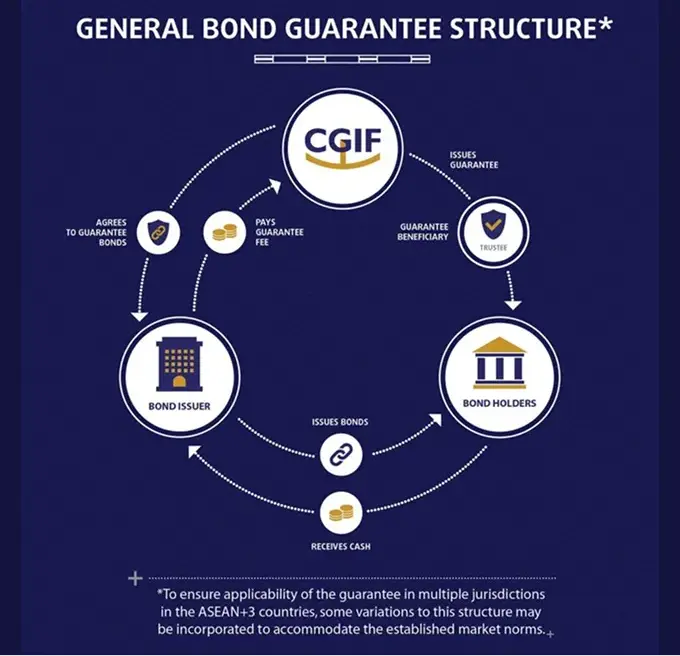

The guarantees issued by CGIF are irrevocable and unconditional commitments to pay bondholders upon non-payment by the issuers throughout the tenor of the bonds. This commitment is backed by CGIF’s equity capital which has been fully paid-in by all of its contributors. CGIF’s general bond guarantee structure is illustrated here.